The fintech revolution continues to accelerate as we move deeper into 2025, with emerging technologies fundamentally transforming how we secure, access, and interact with financial services. While artificial intelligence and digital payments have established their dominance, a new wave of innovations is creating unprecedented opportunities for financial inclusion, security, and sustainability. From quantum-resistant cryptography protecting against future threats to biometric authentication eliminating traditional passwords, the financial services landscape is experiencing its most significant technological transformation yet.

Key fintech statistics and projections showing explosive growth across multiple sectors in 2025

Quantum Computing and Post-Quantum Cryptography: The New Security Frontier

The Quantum Threat Emerges

The advent of quantum computing represents both the greatest opportunity and the most significant threat to financial services security in 2025. Quantum computers possess the theoretical capability to break current encryption methods, including RSA and ECC (Elliptic Curve Cryptography) that underpin most fintech applications today . Financial institutions are now racing against time to implement post-quantum cryptography (PQC) before quantum computers become powerful enough to compromise existing security protocols.

The urgency cannot be overstated. Shor’s algorithm, which runs efficiently on quantum computers, can factor large numbers exponentially faster than classical computers, directly threatening modern cryptographic systems . This poses immediate risks to digital signatures, secure communications, and authentication mechanisms that protect billions of daily financial transactions.

Banking in the Quantum Era

Leading financial institutions are already taking proactive measures. HSBC has implemented quantum-secure technologies including PQC virtual private network (VPN) tunnels and quantum random number generation (QRNG) to protect tokenized gold transactions . Similarly, Banco Sabadell undertook a four-month project exploring PQC adoption, focusing on crypto agility to rapidly switch between cryptographic algorithms as threats evolve .

The US government has set 2035 as the deadline for federal agencies to achieve quantum readiness, providing a clear timeline for financial institutions to complete their transitions . This regulatory pressure, combined with the “harvest now, decrypt later” attack scenarios where cybercriminals collect encrypted data today to decrypt it once quantum computers mature, is driving unprecedented investment in quantum-resistant technologies.

A robotic hand pointing at a digital padlock illustrating AI-powered fraud detection in banking

Enhanced Fraud Detection Through Quantum Computing

Beyond security threats, quantum computing offers remarkable opportunities for fraud detection and risk management. Intesa Sanpaolo has explored quantum machine learning to improve fraud detection using variational quantum circuit (VQC)-based classifiers to analyze hundreds of thousands of transactions . Their quantum model outperformed traditional methods in identifying fraud patterns with better accuracy and efficiency.

McKinsey projects that quantum-computing use cases in finance could create $622 billion in value by 2035, primarily through improving existing processes like risk modeling, portfolio optimization, and real-time fraud detection . As quantum technology advances, its scalability will unlock even greater benefits for the industry.

Biometric Authentication: Beyond Fingerprints and Faces

The Biometric Revolution in Finance

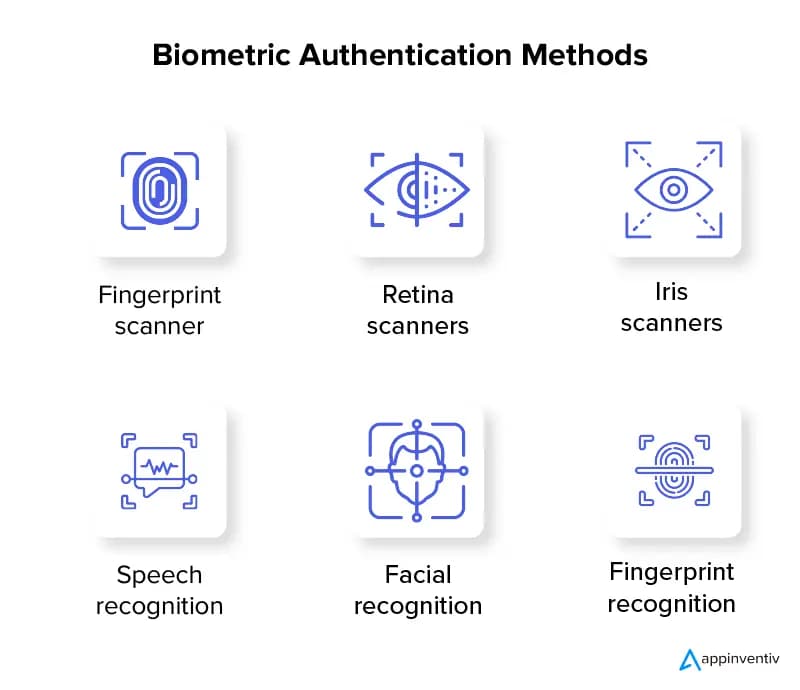

Biometric authentication has evolved far beyond simple fingerprint scanning to become the cornerstone of modern financial security. 79% of financial institutions are either implementing or planning to adopt biometric authentication solutions by 2026, marking a significant shift toward biological identity as the foundation of secure finance . This transformation is driven by alarming fraud statistics: 82% of all fraud in 2024 was linked to impersonation .

Six common biometric authentication methods including fingerprint, retina, iris, speech, and facial recognition

Advanced Biometric Applications

The future of biometric authentication extends into sophisticated applications that were science fiction just years ago. Behavioral biometrics now continuously monitor unique user interactions such as typing speed, mouse movements, and device orientation to detect suspicious activity in real-time . This represents a significant evolution from static biometric systems to dynamic, AI-powered authentication methods.

Financial institutions are implementing multi-modal biometric systems that combine multiple authentication methods for enhanced security. These systems leverage facial recognition with up to 99.97% accuracy, voice authentication for customer service calls, and even wearable biometrics for contactless payments .

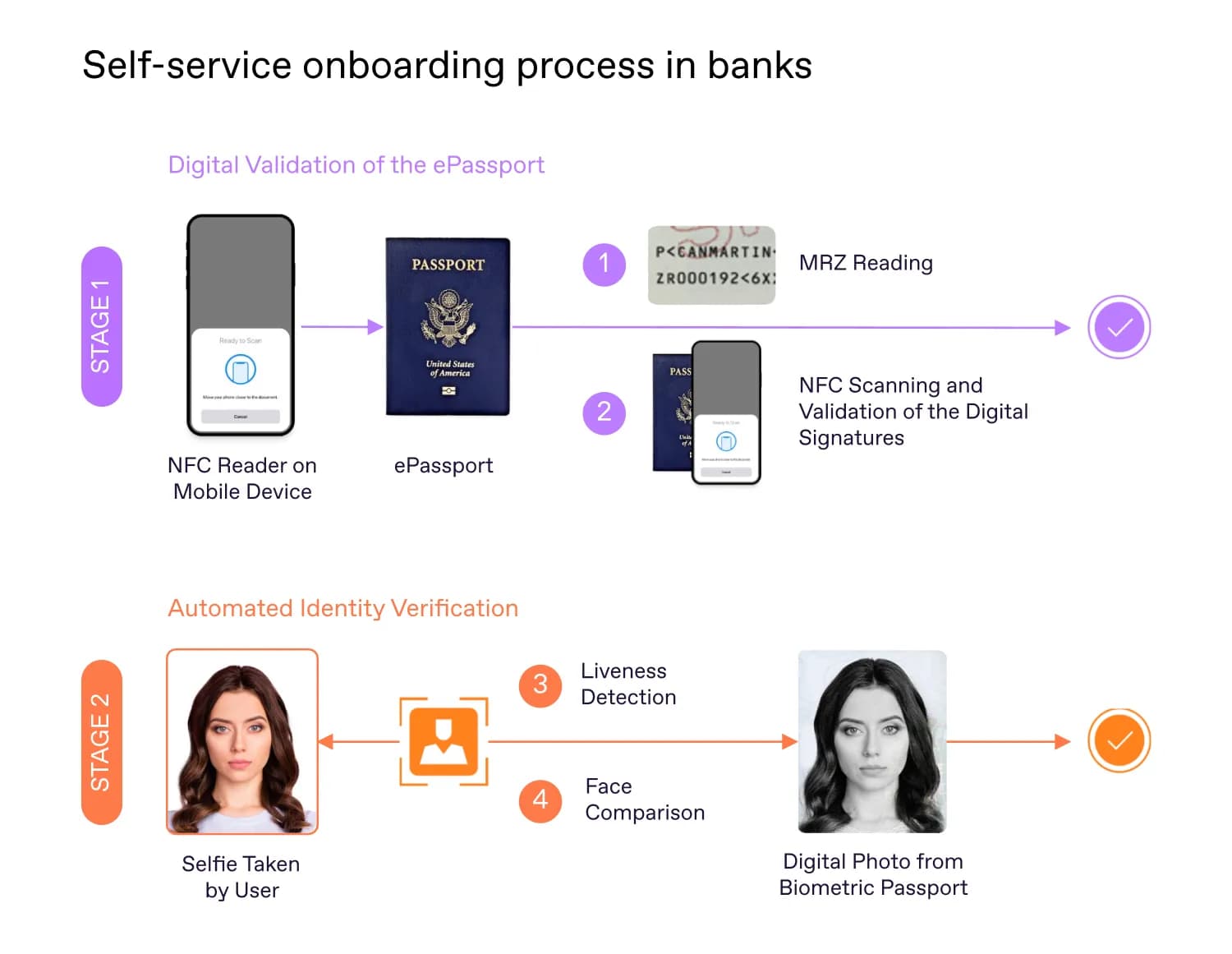

Two-stage self-service onboarding process in banks using digital passport validation and biometric facial verification

Cloud-Based Biometric Infrastructure

The shift toward cloud-based biometric authentication is addressing limitations of device-bound systems. While local biometrics offer privacy, they lack cross-platform support and fail to provide true identity assurance . Cloud-based systems using cryptographic techniques like Secure Multi-Party Computation (sMPC) process biometric data without storing or exposing it, providing stronger identity assurance while maintaining privacy protection .

Central Bank Digital Currencies: Global Expansion Accelerates

Unprecedented CBDC Development

The global race for Central Bank Digital Currencies has intensified dramatically in 2025. 130 countries, representing 98% of global GDP, are now exploring CBDCs, up from 87 countries actively researching the technology . This represents the most significant monetary innovation since the abandonment of the gold standard.

Definition and illustration of Central Bank Digital Currency (CBDC) as digital tokens issued by a central bank

India’s Digital Rupee Success Story

India’s e-rupee has emerged as the second-largest CBDC pilot globally, with digital rupee circulation rising to ₹10.16 billion ($122 million) by March 2025, up 334% from ₹2.34 billion . This remarkable growth demonstrates the practical viability of CBDCs in large-scale implementations and provides a blueprint for other central banks.

CBDC Benefits and Implementation Challenges

CBDCs offer compelling advantages over traditional payment systems, including 24/7 payment processing, reduced infrastructure costs (potentially saving up to 1.5% of a country’s GDP currently spent on cash management), and enhanced financial inclusion for unbanked populations . However, implementation challenges remain significant, particularly around privacy concerns, data security, and the potential reduction of bank deposits that could affect financial system liquidity .

Mobile CBDC payment being made using a secure biometric card and smartphone interface

The European Central Bank’s Digital Euro project continues its investigation phase through October 2025, with privacy identified as the most important feature by both citizens and professionals in consultation processes . The ECB is exploring privacy-enhancing technologies that could enable anonymity in payment processes while allowing auditing in predetermined lawful cases.

Green Fintech and ESG Integration: Sustainable Finance Technology

The Green Finance Revolution

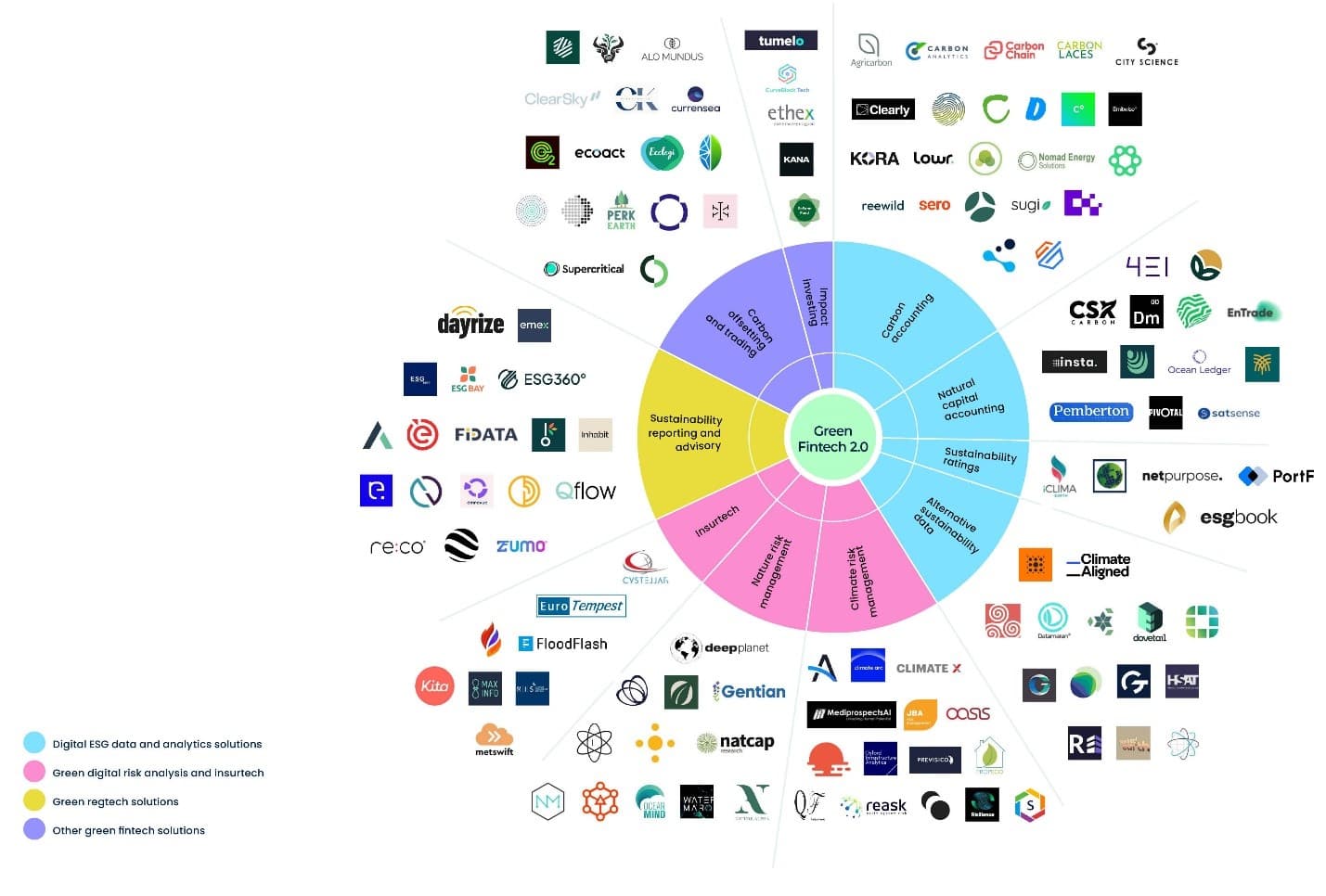

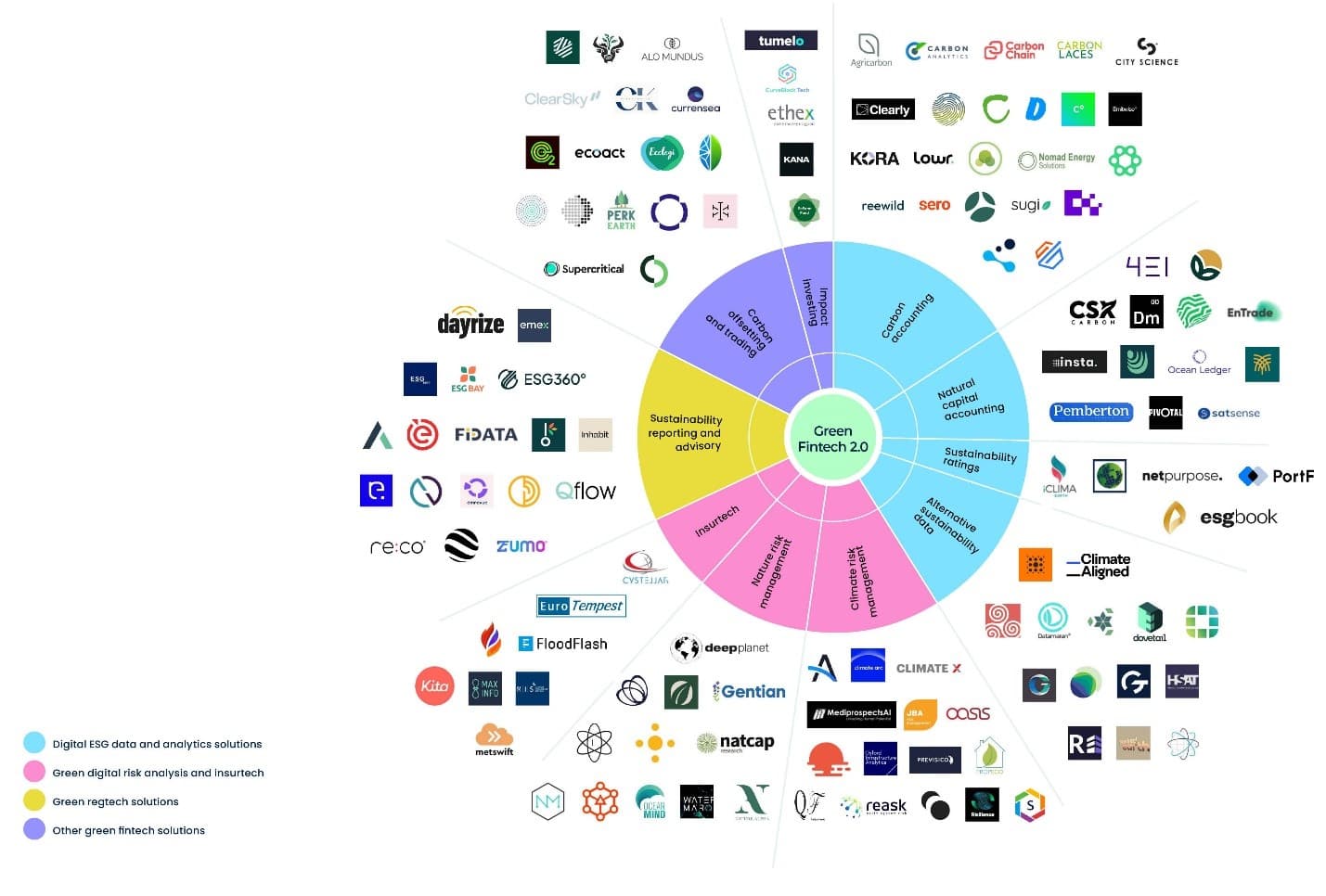

Environmental, Social, and Governance (ESG) considerations are no longer optional add-ons but fundamental components of modern fintech platforms. By 2025, ESG integration in fintech is characterized by greater data sophistication, regulatory alignment, consumer engagement, and transparency . Green fintech solutions are addressing the urgent need for sustainable financial products while creating new revenue streams.

Green Fintech 2.0 infographic categorizing companies by sustainable finance technology sectors such as ESG data, risk analysis, and carbon accounting

Automated ESG Data Management

Green fintech platforms leverage AI, Big Data, IoT, and Natural Language Processing (NLP) to automatically extract ESG-related information from various sources including sustainability reports, satellite imagery, and IoT sensor data . This automation eliminates manual tasks, reduces errors, and accelerates processing speeds while providing real-time ESG risk assessment capabilities.

Companies like Arbol provide weather risk insurance products using AI-powered forecasting models, automatically triggering payouts based on weather station data without requiring manual claims processing . This demonstrates how green fintech can deliver tangible value while promoting environmental resilience.

ESG icons representing environmental, social, and governance factors in sustainable finance and green fintech on a green nature background

ESG Credit Assessment Innovation

AI-powered platforms now analyze satellite imagery and crop yields to evaluate creditworthiness for unbanked farmers, enabling access to climate-smart agriculture financing . This approach uses environmental data to address financial challenges while supporting sustainable development goals, exemplifying the convergence of profitability and environmental responsibility.

Decentralized Finance (DeFi) Maturation and Real-World Applications

DeFi Market Evolution

The DeFi ecosystem has matured significantly in 2025, moving beyond speculative trading toward practical applications with real-world utility. The DeFi market is projected to reach $37.04 billion by 2028, driven by innovations in cross-chain interoperability, real-world asset tokenization, and AI-powered financial automation . While Total Value Locked (TVL) adjusted from $214 billion to $156 billion at the beginning of 2025, this reflects a shift toward sustainable growth rather than failure .

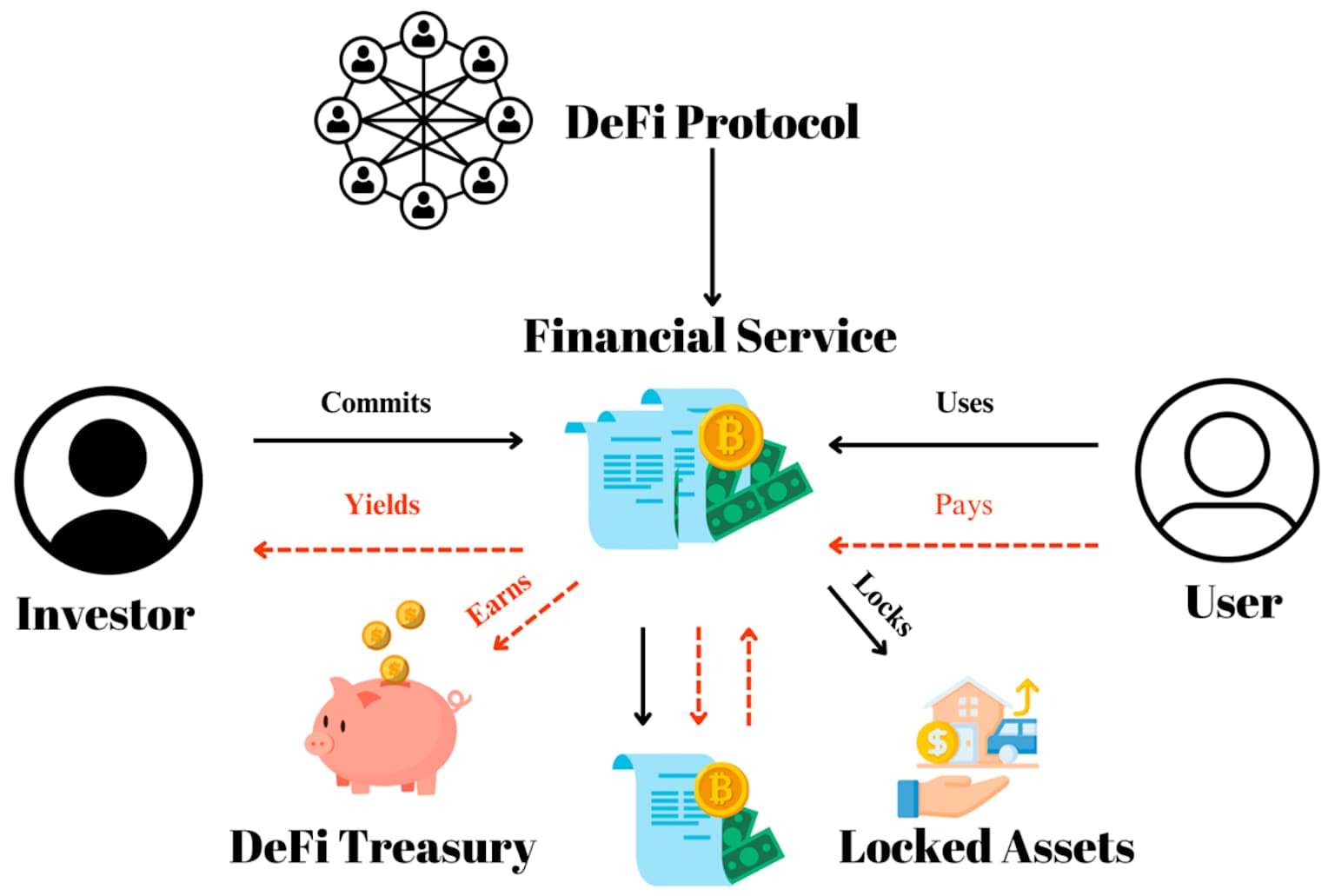

Decentralized Finance (DeFi) explained as a secure, distributed ledger technology similar to cryptocurrencies, illustrated by a network of interconnected people icons

Real-World Asset Tokenization

Real-World Asset (RWA) tokenization is becoming a major DeFi trend, enabling fractional ownership of physical assets such as real estate, commodities, and supply chain assets . Blockchain technology allows users to buy, sell, and trade property shares just like cryptocurrencies, bridging conventional markets with decentralized finance and creating new investment opportunities previously accessible only to large institutions.

Diagram illustrating the relationships and flow of assets within a decentralized finance (DeFi) ecosystem

DeFAI: AI Integration in DeFi Protocols

The integration of artificial intelligence into DeFi protocols (DeFAI) is revolutionizing automated decision-making in lending, trading, and market-making . AI helps boost DeFi protocol performance by automating market making, improving lending logic, and running predictive models that reduce human error while improving capital utilization ratios.

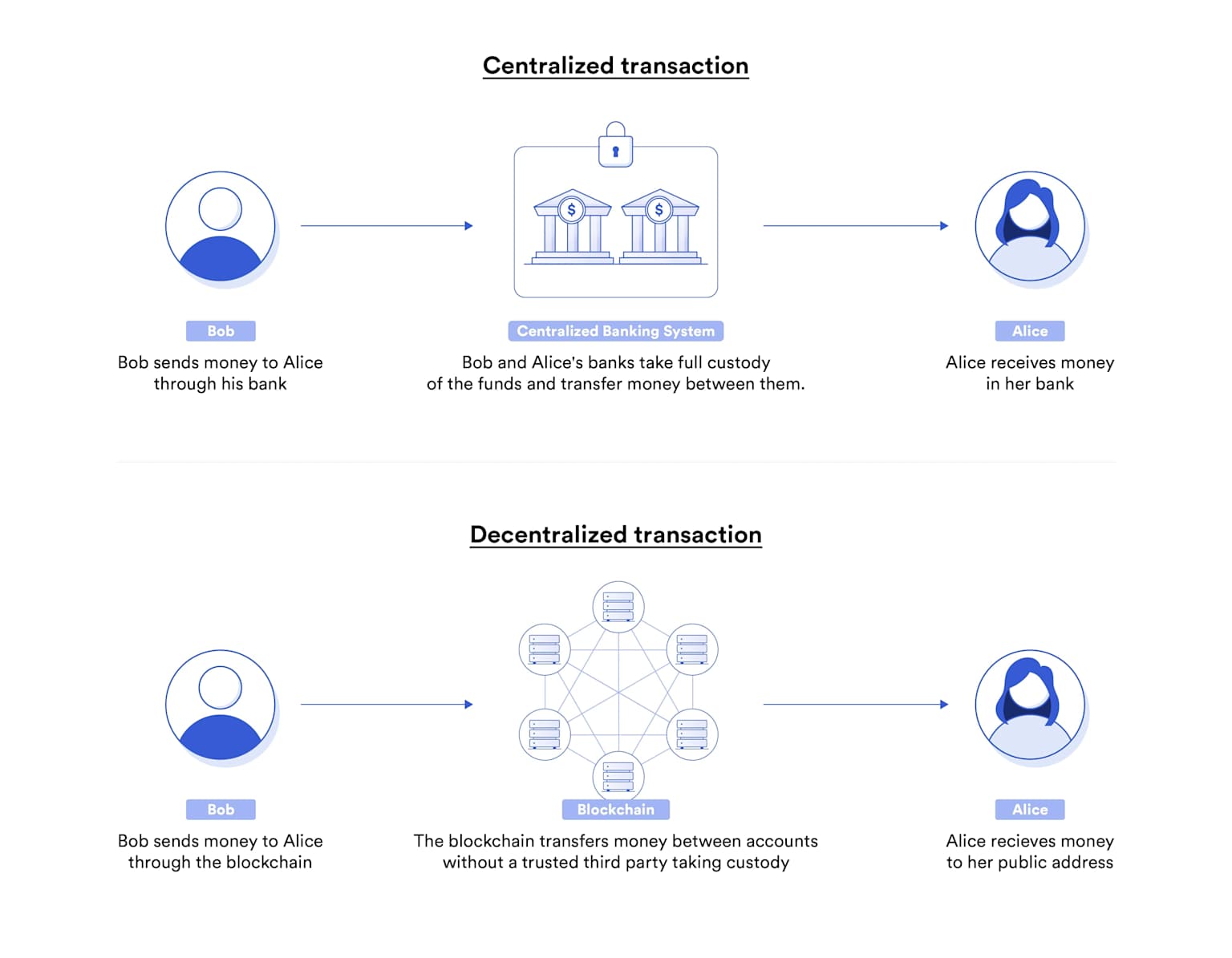

Comparison between centralized banking transactions and decentralized blockchain transactions illustrating DeFi concepts

RegTech Revolution: Automation Meets Compliance

The $66.9 Billion RegTech Market

Regulatory Technology (RegTech) reached a valuation of $9 billion in 2022, with projected growth to $66.9 billion by 2032, showcasing an impressive CAGR of 22.6% . This explosive growth reflects the urgent need for technological solutions to manage increasingly complex regulatory requirements across global financial markets.

AI-Powered Compliance Solutions

RegTech solutions leverage machine learning, natural language processing, blockchain, and AI to automate compliance processes that were previously manual and error-prone . These technologies enable real-time monitoring, automated reporting, and predictive risk assessment, helping financial institutions reduce compliance costs by 15-20% annually while improving accuracy .

Cross-Border Compliance Automation

As financial institutions operate across multiple jurisdictions, RegTech solutions address cross-border compliance complexities including differences in legal frameworks, data privacy requirements, and reporting standards . Automated transaction monitoring systems now process millions of transactions in real-time, identifying suspicious patterns and generating regulatory reports without human intervention.

Super Apps and Financial Ecosystems: The Platform Revolution

The Rise of Financial Super Apps

Super apps are revolutionizing digital ecosystems by integrating multiple financial services, e-commerce, and lifestyle functions into single platforms . In Asia, the popularity of super apps is driven by high smartphone penetration, robust digital infrastructure, and rapid adoption of digital services, with platforms like WeChat and Alipay each serving over a billion active users .

The Indian market shows particular promise for super app expansion, with platforms like Paytm, SBI Yono, and PhonePe evolving into comprehensive financial hubs offering payments, loans, investments, and insurance services within single applications . These platforms eliminate the need for users to switch between multiple applications, enhancing engagement and cementing customer loyalty.

Banking-as-a-Platform Integration

Traditional financial institutions are embracing Banking-as-a-Service (BaaS) and Banking-as-a-Platform (BaaP) models by integrating with or developing super app capabilities . This convergence allows banks to offer their services through third-party platforms while maintaining regulatory compliance and customer relationships.

IoT and Blockchain: Connected Financial Services

IoT in Financial Services Growth

The IoT in financial services market is set to grow from $2.61 billion in 2024 to $52.38 billion by 2031, driven by demand for automation and real-time financial insights . IoT devices are enabling new applications in fraud prevention, automated compliance monitoring, and personalized financial services based on real-time behavioral data.

Blockchain-IoT Integration

IoT devices create tamper-resistant records on blockchain networks, enabling secure sharing of financial data among multiple parties without centralized control . This integration supports applications from supply chain finance to automated insurance claims processing, where IoT sensors trigger smart contract payments based on predetermined conditions.

Financial Inclusion Through Digital Innovation

Rural Banking Transformation

Digital banking initiatives are dramatically improving financial inclusion in rural economies, where traditional banking infrastructure remains limited . Mobile banking, digital wallets, and agent banking models provide rural populations with convenient, affordable access to financial services including savings, credit, payments, and insurance.

India’s rural fintech adoption demonstrates the transformative potential of mobile-first solutions, with regional language support, simplified onboarding, and voice-led user interfaces building trust and improving usability . These innovations are extending financial services to previously underserved populations while supporting sustainable economic development.

Conclusion: The Future of Finance is Now

The fintech landscape of 2025 represents a convergence of breakthrough technologies that are fundamentally reshaping financial services. From quantum-resistant cryptography protecting against future threats to biometric authentication eliminating passwords forever, these innovations are creating a more secure, inclusive, and efficient financial ecosystem.

The success of these technologies depends on collaboration between fintech innovators, traditional financial institutions, regulators, and technology providers. As 83% of fintechs report improved customer experience from AI adoption and approximately three-quarters note higher profitability and reduced costs , the business case for embracing these innovations becomes increasingly compelling.

Looking ahead, the financial services industry must prepare for a future where quantum computing, biometric authentication, central bank digital currencies, and sustainable finance technologies are not emerging trends but fundamental infrastructure. Organizations that invest in these technologies today will be best positioned to serve customers in an increasingly digital, secure, and sustainable financial future.

The transformation is accelerating, and the opportunities are unprecedented. The question is no longer whether these technologies will reshape finance, but how quickly institutions can adapt to leverage their full potential while maintaining the trust and security that customers demand.